Filing taxes with H&R Block’s application and website

Saturday, March 12, 2016 at 8:51AM

Saturday, March 12, 2016 at 8:51AM

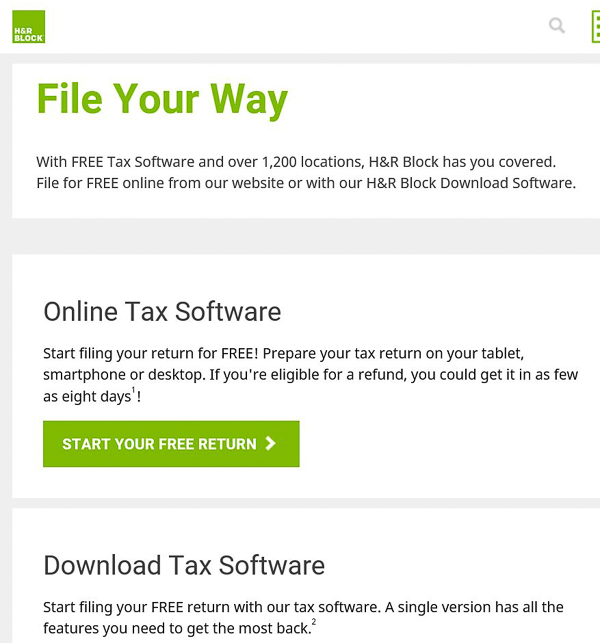

Believe it or not, we’ve already arrived at our Tax Season. What is traditionally a nervous and often stressful time for individuals and families filing their taxes can be made much simpler by using H&R Block’s new online tax submission tools including their downloadable program and tax filing website which works on PCs as well as mobile devices.

H&R Block has over 50 years of Canadian tax return experience and serves Canadian taxpayers in 1,200 offices across the country as well as its various web tools and downloadablle application.

This year, I decided to use the new online submission process to file my taxes. As a self-employed freelancer, there are certain things for me to consider and include as business expenses which employed filers don’t need to consider. I was happy to learn that H&R Block’s online system takes these into consideration and makes the process quick and easy.

This year’s version of H&R Block’s Tax Software builds on its process of continually reinventing the online tax preparation experience for Canadians.

This year’s version of H&R Block’s Tax Software builds on its process of continually reinventing the online tax preparation experience for Canadians.

Users will also enjoy a fresh design that provides customers with access to expert resources as they prepare their tax return. This became apparent to me at every step of the process. The system’s Enhanced Help Centre helps demystify the process while offering helpful tips along the way.

Options in abundance

What I liked about H&R Block’s approach this year was the range of options available for filing. There’s an easy download solution which, once installed on your PC, makes it possible to file directly from the application.

There’s also a web-based filing tool, which is my preferred method of filing taxes. Once I created my account, I could sign in from any device and even my mobile phone or tablet and continue filing as needed. It is really convenient to be able to file your taxes from any device you are most comfortable with.

I know some people who don’t even use their PCs anymore and prefer iPads for their communication, social media or email and making H&R Block’s solution available on the platforms people use most isn’t only smart, it is thoughtful.

For switchers, H&R Block has made it easy to import data from competing tax preparation software applications like Ufile or Turbotax.

Step-by-step submission

After gathering all my documents, I fired up my web browser and went to the H&R Block website and created an account. From this point, it is easy to toggle either French or English language.

From there, the website walks you through a step-by-step process for filing taxes. If anything is unclear along the way, there’s lot of opportunity for clarification. For anything that the system can’t answer, I felt confident that any of the affiliate tax experts, which the website has in a directory, could be approached to help me along the way.

I used the browser-based system on my notebook PC as well as my iPad Pro and found using both interfaces quite easy and familiar. Compared to last year’s submission experience, I found things to be more intuitive overall.

Conclusion

I’ve always been a bit wary of filing my own taxes because of the possibility of not understanding the process, making mistakes and not getting a fair tax return for my family. Free services always seemed too good to be true, but H&R Block’s service has proven to be both free and super effective. It has various options for assisting users though online guides and even makes tax experts easily accessible to address any concerns or questions for free as well.

Reader Comments