The Apple Beat: Why Apple Pay is sending shockwaves through the payments industry

Thursday, October 2, 2014 at 10:59AM

Thursday, October 2, 2014 at 10:59AM

By Gadjo Cardenas Sevilla

By Gadjo Cardenas Sevilla

Apple Pay is actually a very big deal. More than just enabling mobile payments in a handful of partner retailers, the entire system is designed to ‘just work’ once the switch is flipped. Apple Pay will hope to become as prevalent a payment option as Visa, MasterCard or any debit card that people are already using.

The first public Apple Pay transaction is still a few weeks away from happening, but news that Apple’s solution to mobile payments is coming, is sending shockwaves through the payments sector.

A key feature of the new iPhone 6, iPhone 6 Plus and Apple Watch, Apple Pay has the backing of major credit card companies, over 800 million ready-to-go credit cards on iTunes, various debit cards plus 220,000 retailers and businesses have already signed up or, at the very least, already have the necessary infrastructure to accept Apple Pay without any large investment in hardware or training.

More importantly, Apple has made it easy for iPhone users to set-up accounts and payment options with PassBook, a technology that’s been around for a few years. PassBook has been effective for checking into flights, buying lattes at Starbucks so transitioning from these niche touchless and tap-to-pay transactions to a larger range of mobile purchases will be quite easy.

Apple hopes to succeed where so many individuals and groups have failed. When Apple Pay was announced earlier this month, various competitors scoffed saying they had NFC in their phones for years. BlackBerry pioneered the buying of Tim Horton’s Coffee with phones two years ago, no big deal.

Well, Apple Pay is actually a very big deal. More than just enabling mobile payments in a handful of partner retailers, the entire system is designed to ‘just work’ once the switch is flipped. Apple Pay will hope to become as prevalent a payment option as Visa, MasterCard or any debit card that people are already using.

Shockwaves

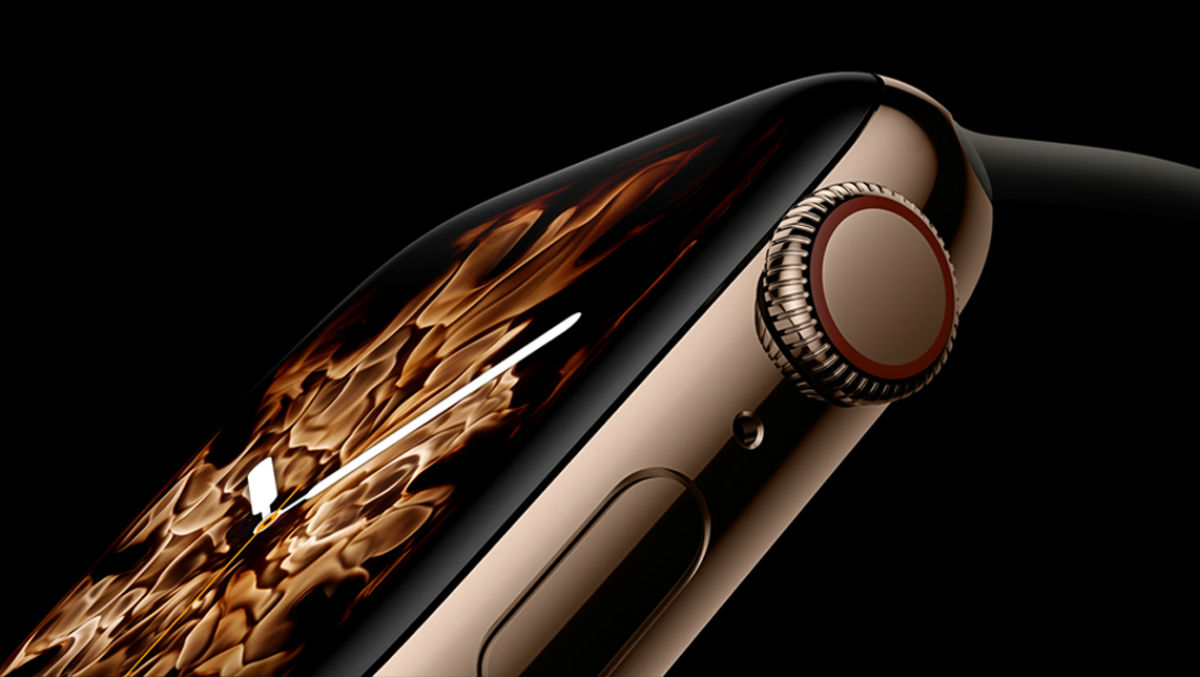

Apple Watch will be another conduit for Apple Pay

Apple Watch will be another conduit for Apple Pay

PayPal, rumoured to be considered as an Apple Pay partner but which teamed up with Samsung instead, now feels the threat from an Apple-led payment consortium.

eBay, which owns PayPal, is moving to spin it off as a separate company in the hopes that PayPal will be able to be more nimble in generating innovation as well as the necessary partnerships to become a major player in the mobile payments game.

Softcard (formerly ISIS), was the biggest telco-driven consortium built around mobile payments in the US, and one that for years tried to develop a standard in NFC-focused mobile payments. Soft card is now actively working with Apple to enable their services in 2015. Square, which builds-mobile terminals and payment systems doesn’t see Apple Pay as a competitor, but rather as a complimentary service.

The landscape of mobile payments is certainly changing, and quickly. Apple Pay was not revealed as a work in progress but as a wholly fleshed out system that uses existing NFC terminals and simply puts Apple’s wide ecosystems and cloud services into a singular focus to enable quick and secure mobile payments.

How it works

As seen in the demo above, Apple Pay was designed to be extremely quick and easy. Once an item for sale is scanned user’s simply have to bring their iPhone 6 or iPhone 6 Plus near the terminal and verify their identity with the built-in Touch ID feature.

As Apple explains it, “There's no need to open an app or even wake your display thanks to the innovative Near Field Communication antenna in iPhone 6. To pay, just hold your iPhone near the contactless reader with your finger on Touch ID. You don’t even have to look at the screen to know your payment information was successfully sent. A subtle vibration and beep lets you know.” Receipts are either printed out on the spot or emailed to you for reference and filing.

Apple Pay will also be used for online payments, which competes directly with PayPal. IF you're viewing a website that accepts Apple Pay, you can simply authenticate then and there and pay for your item. More importantly, Apple has stressed the security of the system.

“With Apple Pay, instead of using your actual credit and debit card numbers when you add your card to Passbook, a unique Device Account Number is assigned, encrypted, and securely stored in the Secure Element, a dedicated chip in iPhone. These numbers are never stored on Apple servers. And when you make a purchase, the Device Account Number, along with a transaction-specific dynamic security code, is used to process your payment. So your actual credit or debit card numbers are never shared by Apple with merchants or transmitted with payment.” Apple doesn’t see any of your transaction information either.

Should your iPhone get lost or stolen, you can remotely put it in lost-mode disabling any payment functionality. Moreover, if you can’t retrieve the device, it can be remotely wiped.

Moving forward

There are still various hurdles that Apple Pay needs to overcome to be fully accepted as the de facto mobile and online payments solution. The efficiency of the cloud aspect, security of Touch ID as a verification solution and just general notion that any new way to pay is inherently risky.

There will also be users who will feel vulnerable having their expensive phone and all their valuable credit and financial information in one device, specially in the wake of recent brute-force attacks on celebrity devices and accounts exposing their private photos and information. Users will no doubt need assurances that the system is safe and their information is well preserved.

Adoption outside of the US, is another consideration. Apple Pay will be a global solution, but applying regulations to Apple Pay partners and retailers in various countries could take time. Apple will want Apple Pay deployed in as many countries as quickly as possible before competitors try and make their move.

Apple doesn't just have a system in place, it has the hardware, the software, the cloud ecosystem and the right partners to make sure Apple Pay works as designed.

If deployed successfully, Apple Pay would be the biggest and most potentially game changing solution for secure mobile payments.

Reader Comments